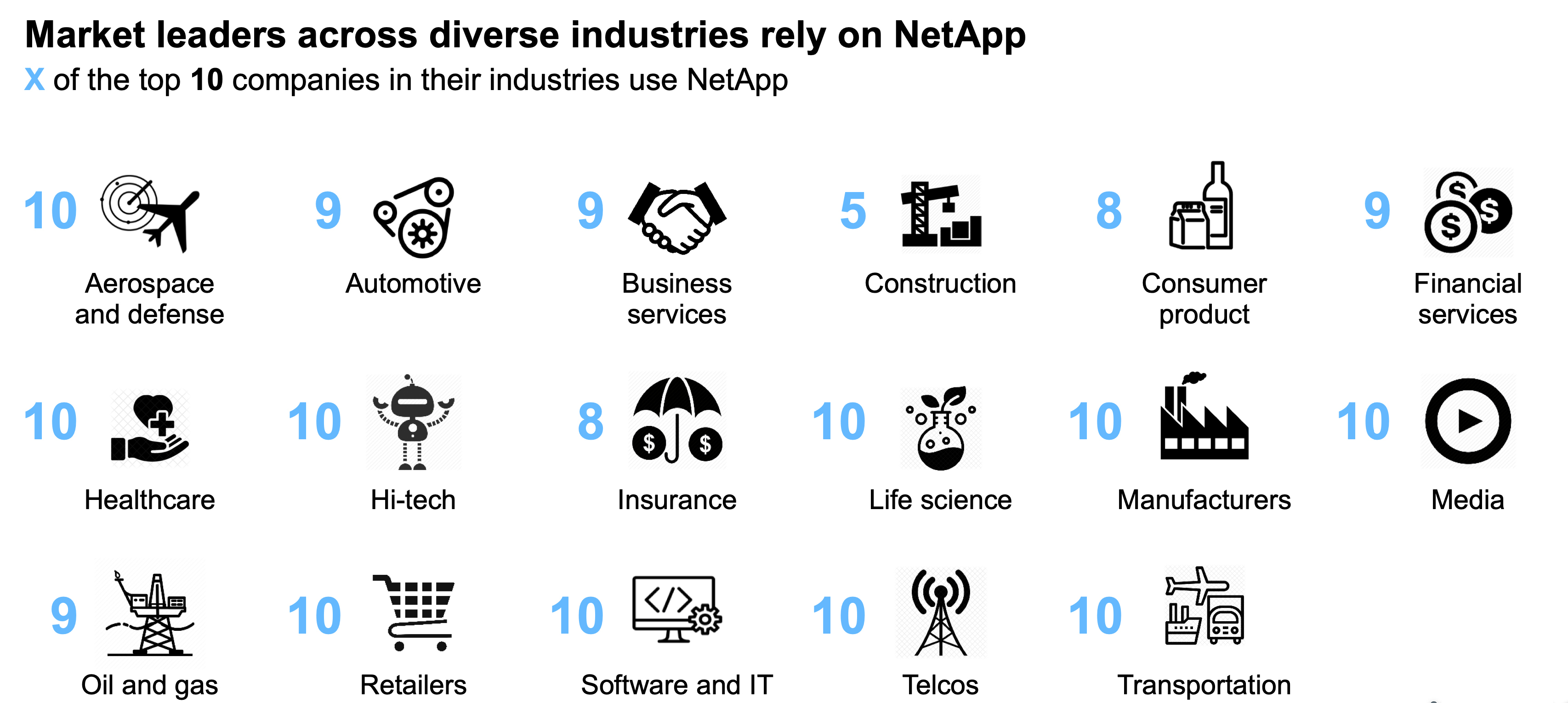

At current share prices near $87, NetApp trades at a relatively modest 15.8x P/E ratio versus FY23 pro forma EPS expectations of $5.54 (data from Yahoo Finance). NetApp customer profile (NetApp Q2 investor presentation)īy far the biggest appeal to NetApp, however, is its relatively rare orientation as a value stock within the tech sector. The slide below showcases the diversity of NetApp's vertical offerings, and the numbers in blue represent the portion of the top-10 largest companies of each industry that are NetApp customers: Backup and recovery, as well security and analytics tools, make NetApp a one-stop shop for data storage and management needs.ĭespite a potentially undeserved reputation as a "legacy" tech provider, NetApp counts some of the top companies in various industries among its customer base.

#Netapp stock pro full#

And, the company continues to offer a full stack of storage solutions, from flash to data storage solutions specifically made for unstructured data. For customers looking to adopt a "hybrid cloud" solution (with some assets in the cloud, and others remaining behind in private data centers), NetApp has products that offer cloud-like agility even in on-prem environments as well. The company offers data management and storage solutions compatible with the three largest public cloud vendors: Amazon AWS ( AMZN), Microsoft Azure ( MSFT), and Google Cloud ( GOOG). NetApp has optimized itself for the cloud-first IT environment. Despite this long stretch of outperformance, I remain solidly bullish on this name. Since buying into NetApp at around $40 per share, the stock has more than doubled as well as avoiding the steep crash seen in other tech stocks over the past quarter. I first recommended going long on NetApp during the thick of the pandemic, in September 2020. Down 5% since the start of the year in sympathy with other stocks, it's a good time to buy into the slight dip on NetApp: As proof: its stock is up 25% over the past year, a big outperformance versus many high-flying tech stocks that have cratered since November. It was a leader in the storage market before its dominance was supplanted by companies like Pure Storage ( PSTG) which specialized in higher-performance flash storage solutions for several years, NetApp suffered from revenue declines and stagnation.īut though late to the cloud game, NetApp has seen a turnaround. Founded in 1992, NetApp has now been around for three decades. NetApp ( NASDAQ: NTAP ), a storage company that has made a recent resurgence by focusing on cloud product sales, is an under-the-radar name that makes for a perfect "safe" investment in the current market.įew tech companies ever age as NetApp has.

JasonDoiy/iStock Unreleased via Getty ImagesĪs the markets continue to trade in a choppy fashion, investors would be wise to double down on value-oriented plays, especially those that can allow us to maintain or increase our exposure to a declining tech sector.

0 kommentar(er)

0 kommentar(er)